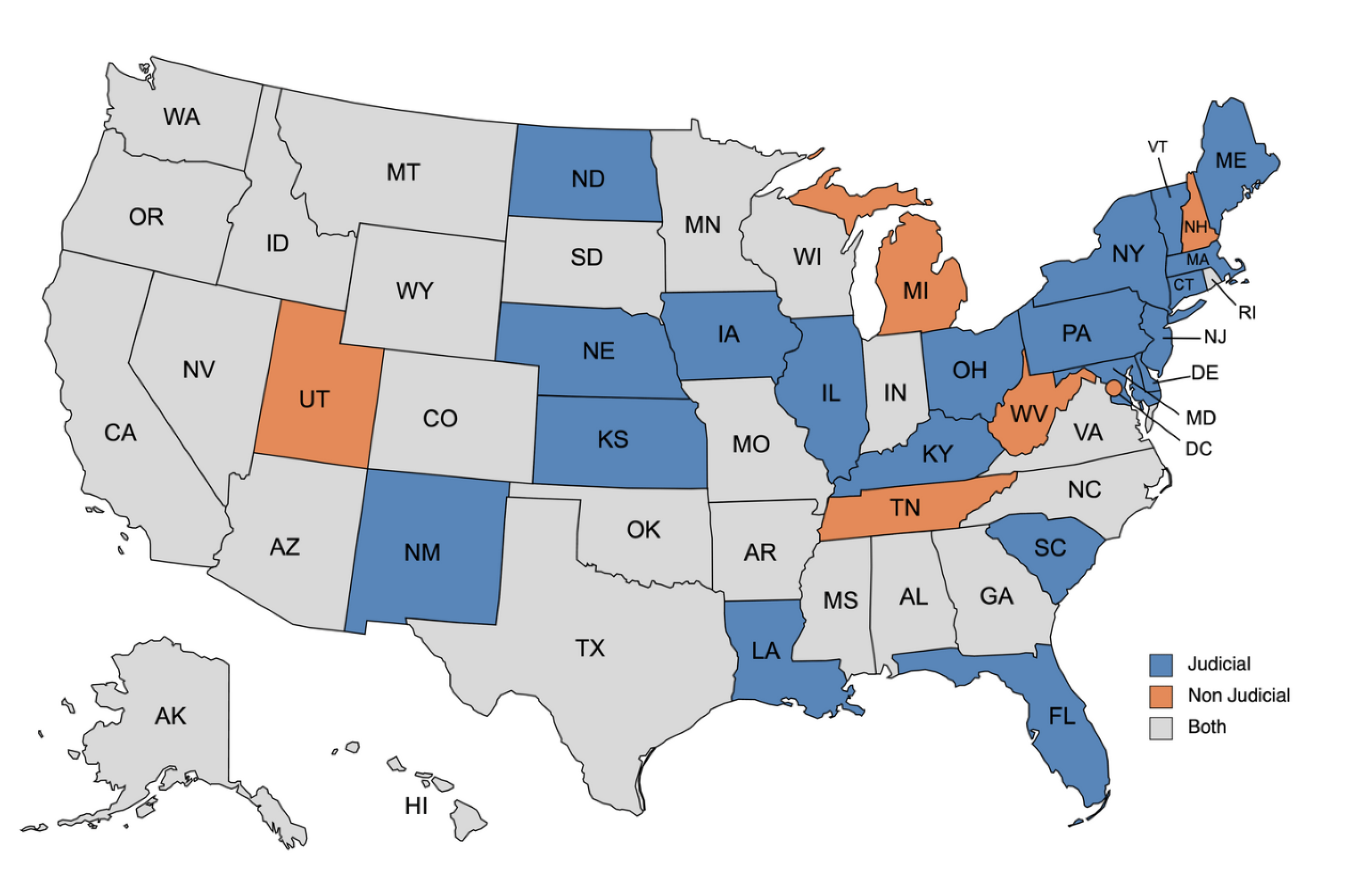

When engaging in real estate money lending, particularly in the context of foreclosures, it’s crucial to understand the distinction between judicial and non-judicial states. This differentiation affects the foreclosure process, influencing both lenders and borrowers.

Judicial Foreclosure States

In judicial foreclosure states, the foreclosure process is conducted through the court system. Here’s how it typically works:

- Initiation: When a borrower defaults on a mortgage, the lender must file a lawsuit in court to initiate the foreclosure process.

- Litigation: The court becomes involved, and the borrower is served with a complaint and summons. The borrower then has the opportunity to respond and present defenses.

- Court Proceedings: If the borrower contests the foreclosure, the case may go to trial. If the borrower does not respond or loses the case, the court will issue a judgment of foreclosure.

- Auction: Following the court’s judgment, the property is typically sold at a public auction supervised by the court.

- Redemption Period: Some states provide a redemption period after the sale, allowing the borrower to reclaim the property by paying the full amount of the defaulted loan plus costs.

Advantages of Judicial Foreclosures

- Borrower Protections: The judicial process offers more protections for borrowers, including the opportunity to contest the foreclosure and assert defenses.

- Clear Title: Court supervision can result in a clearer title for the purchaser, as the court order extinguishes junior liens and claims.

Disadvantages of Judicial Foreclosures

- Time-Consuming: Judicial foreclosures are typically slower than non-judicial processes, often taking several months to over a year.

- Costly: The process involves legal fees and court costs, making it more expensive for lenders.

Non-Judicial Foreclosure States

In non-judicial foreclosure states, the process is handled outside the court system, following specific procedures outlined in state statutes and the deed of trust or mortgage agreement. Here’s an overview:

- Power of Sale Clause: Most non-judicial foreclosures are based on a power of sale clause in the mortgage or deed of trust, which grants the lender the right to sell the property upon default.

- Notice of Default: The lender must typically issue a notice of default to the borrower, giving them a certain period to cure the default.

- Notice of Sale: If the borrower does not cure the default, the lender then issues a notice of sale, which must be publicly posted and published according to state law.

- Auction: The property is sold at a public auction to the highest bidder, usually without court involvement.

- Redemption Period: Similar to judicial states, some non-judicial states provide a redemption period post-sale.

Advantages of Non-Judicial Foreclosures

- Speed: Non-judicial foreclosures are generally faster, often concluding in a matter of months, as they bypass the court system.

- Cost-Effective: The absence of court costs and reduced legal fees make the process less expensive for lenders.

Disadvantages of Non-Judicial Foreclosures

- Limited Borrower Protections: Borrowers have fewer opportunities to contest the foreclosure and may have less time to remedy the default.

- Title Issues: Non-judicial foreclosures can result in title issues, as junior lienholders might not be adequately addressed, potentially leading to future legal complications.

Implications for Real Estate Money Lending

Understanding the foreclosure process in the state where the property is located is essential for both lenders and borrowers. Here are some key implications:

- Risk Assessment: Lenders need to evaluate the risks associated with each type of foreclosure. Judicial foreclosures, while more protective for borrowers, can delay recovery and increase costs for lenders. Non-judicial foreclosures offer quicker resolution but carry the risk of title disputes and less borrower protection.

- Loan Terms: The type of foreclosure process may influence the terms of the loan. For instance, in non-judicial states, lenders might offer more favorable terms due to the lower risk of prolonged litigation.

- Investment Decisions: Real estate investors must consider the foreclosure laws when purchasing properties, especially distressed properties. The ease or difficulty of foreclosure can impact the potential return on investment and strategy.

- Borrower Considerations: Borrowers should be aware of their state’s foreclosure laws to understand their rights and the potential consequences of defaulting on a mortgage. In judicial states, borrowers have more avenues to delay or contest foreclosures, which might provide additional time to negotiate alternatives such as loan modifications.

- Legal Compliance: Both lenders and borrowers must ensure compliance with state-specific foreclosure procedures. Non-compliance can result in legal challenges, delays, and additional costs.

Case Studies

- Michigan: A non-judicial state, Michigan’s streamlined process allows lenders to foreclose without court involvement, typically within four months. However, it also imposes strict notice requirements and offers some borrower protections, such as the right to reinstate the loan before the sale.

- New York: As a judicial foreclosure state, New York requires lenders to go through the courts, often resulting in a lengthy process that can take over a year. The court-supervised process provides a clear title but at a higher cost and longer timeline.

Conclusion

The distinction between judicial and non-judicial states is a fundamental aspect of real estate money lending, directly influencing foreclosure procedures, borrower protections, and the overall cost and speed of resolving defaults. Lenders must weigh these factors when making lending decisions, while borrowers need to understand their rights and options under their state’s foreclosure laws. Whether in a judicial or non-judicial state, staying informed and compliant with the relevant procedures is key to navigating the complexities of real estate money lending and foreclosure.