Atlanta, GA

Custom-designed, new construction home on a prime 0.62 acre lot located in the residential area of Chastain Park. The property is within walking distance to Chastain recreational activities, shopping, and restaurants.

Log In

Structure

- Tax Document

- 1099-INT

- Offering Structure

-

BPDNx

SENIOR BPDN - PROMISSORY NOTE SECURED BY COLLATERAL SECURITY AGREEMENTTHIS PROMISSORY NOTE IS SECURED BY THE ISSUER'S PLEDGE OF THE RELEVANT UNDERLYING COLLATERAL LOAN (AS DEFINED BELOW) TO THE LENDER (AS DEFINED BELOW) UNDER THE COLLATERAL SECURITY AGREEMENT AND PROMISSORY NOTE. HOWEVER, EXCEPT TO THE LIMITED EXTENT PROVIDED IN THE PROMISSORY NOTE WITH RESPECT TO THE UNDERLYING COLLATERAL LOAN, THIS NOTE IS NON-RECOURSE TO THE ASSETS, FUNDS AND ACCOUNTS OF YIELDI, LLC (THE "BORROWER", "COMPANY" OR "ISSUER") OR ANY OF ITS AFFILIATES, EMPLOYEES, AGENTS, STOCKHOLDERS, PARENTS, OR SUBSIDIARIES EXCEPT TO THE EXTENT OF THE VALUE OF COLLATERAL LOAN NET PAYMENTS ACTUALLY RECEIVED IN RESPECT OF THE UNDERLYING BORROWER LOAN.

Example Return on Investment

-

Investment Amount:

-

Annual ROI:

-

$0

Why We Like This Opportunity

Property Highlights

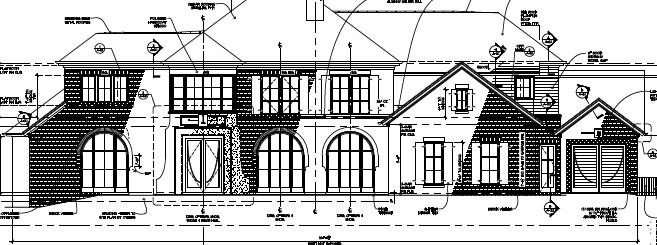

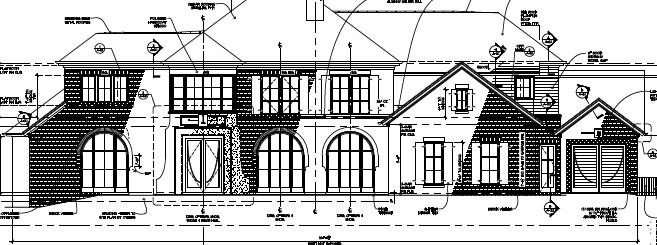

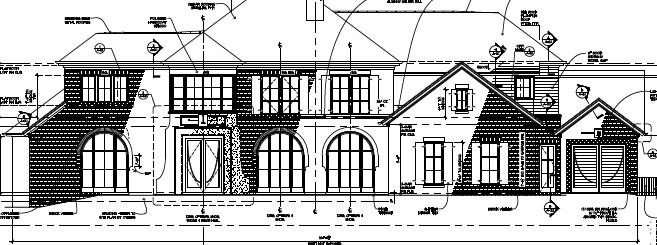

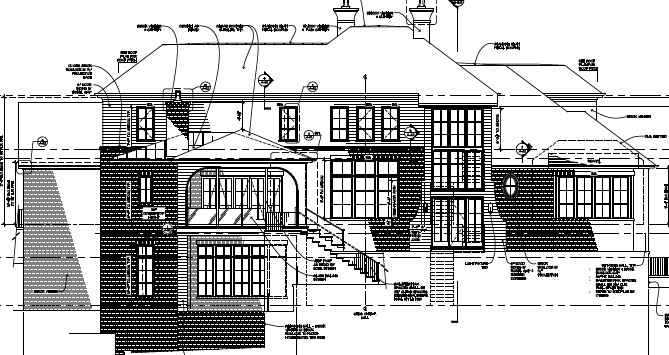

Custom-designed, new construction home on a prime 0.62 acre lot located in the residential area of Chastain Park. The property is within walking distance to Chastain recreational activities, shopping, and restaurants. The custom build boasts a first floor with 4,303 sq. ft. of heated space that includes the master suite, pool bath, keeping room, and scullery along with your family room, kitchen and dining room. The second floor includes 2,793 sq. ft. of heated space with 4 bedrooms, 4 full baths, and a playroom. The finished basement will contain 3,491 sq. ft. of heated space with a gym, media room, and a bedroom with a full bath.

About the Neighborhood

Chastain Park is a large community in Buckhead and Sandy Springs, Georgia. The community’s namesake is Atlanta’s second largest park. The 268-acre park begins at Sandy Springs’ southern city limit, but the community extends well into Sandy Springs. Chastain Park is the hub of activity and the main draw for families to this area. The park contains a network of walking trails, several playgrounds, and a community swimming pool. Local sports teams and organizations compete on the park’s tennis courts, baseball diamonds, and soccer fields. The park is also home to the North Fulton Golf Course and the Chastain Horse Park. The average sales price of a home in a Chastain Park neighborhood over the past 12 months was $2,608,978, which is 56.79% above last year’s average of $1,663,988. The average home was on the market for 31 days.

Why We Like This Opportunity

This is a first position construction mortgage with an excellent loan to value ratio of 66% with an as-completed property value of $5,250,000.00 and a construction loan amount of $3,500,000.00. The borrower secured this Chastain lot for $1,200,000.00, and all permitting is complete. The initial funding amount of this loan is $800,000 which is 66% of the original purchase price and includes funds for their initial draws for demolition. This builder has an excellent track record and builds a really nice product.

Seniority

The first-priority mortgage lien position is the most senior and highest priority within the capital structure. In the event that a borrower defaults, the lien priority determines the order in which lenders are repaid. Senior lenders are always repaid first. All subordinated positions, including the amount held by the Originator and its investor syndicate, act as a buffer in the event of a deterioration in the Properties’ value.Personal Guarantee

The Loans are personally guaranteed by the borrower, spouse, and all principals in the LLC. Additionally, the Sponsor and/or Guarantor are obligated to contribute monthly payments to maintain a tax and insurance reserve. Failure to adhere to reserve contribution requirements would lead to the triggering of a debt service and operating expense/shortfall guarantee.

Upfront Reserve

The Loan is structured with interest reserve for further protection. 12 months of debt service payments will be collected at closing.What Should I Consider?

Borrower Risk

The Borrower may not have represented itself accurately. Risk Mitigation- The Originator checks the Borrower's credit history via a third-party credit reporting company. The Borrower has a 700 credit score.

- The Originator considers the underlying asset to be the primary source of security.

- If the Loans are not fully repaid after the Lender has exhausted other sources of repayment, the Borrower has provided a personal guaranty to fulfill any deficiency.

Default Risk

The Borrower may default on his financial obligations. Risk Mitigation- If the Loans are not fully repaid after the Lender has exhausted other sources of repayment, the Sponsor has provided a personal guaranty to fulfill any deficiency.

- In the event of a default, a direction letter signed at closing by the Borrower will be sent redirecting the Tenant to make rent payments into an account controlled by the Originator.

Investment Summary

Investors have an opportunity to invest in borrower payment dependent notes, the cash flow of which is dependent on the payment of interest and principal repayment on the Loans. Investors are scheduled to receive an annualized monthly interest payment of over the Loans' estimated remaining term of 15 Months. Principal is expected to be returned on or before maturity through a refinancing with a traditional bank loan. It is important to note that the Loans are eligible for prepayment, and principal may be repaid prior to the 15 Months estimated remaining term. If the Loans are paid off before maturity, investors are expected to receive at least three months of interest payments in addition to return of principal.

How Do I Get Paid?

This loan had an initial term of 15 Months with an option at Yieldi's discretion to extend. As of March 19, 2024 there are 15 Months remaining. Investors will immediately receive monthly interest payments at an annualized rate of on the principal balance over the life of the loan. If you invest in this loan in the middle of a month, you will receive a prorated interest payment for your investment for your first investment month and then full monthly payments thereafter. All payments are made automatically via ACH on the 1st of each month and investors all paid by the 10th of the month.

Additional Resources

Types of Investment Vehicles: Real Estate vs Alternatives

The goal of investing is to make money—and different types of investment vehicles do this at different rates and different levels of risk. People invest for a variety of reasons. Some do it for a living, while others invest to put money away for their retirement. Everyone has a unique situation with unique goals. The…

What Is Transactional Funding? (And What’s the Best for You?)

Transactional funding is an option you need to know for quick real estate transactions where you need same-day or next-day financing! Funding is one of the most challenging aspects of real estate investing. Transactional funding often comes in handy with wholesaling, but there are several instances where this could be the right option for you….

Private Lenders vs Traditional Banks: Which Is Best?

Private mortgage lenders vs. banks—what’s the difference? While it might seem like a trivial decision, who you choose to finance your real estate purchase can make a huge impact on your experience. Buying a home can be a complex process. It’s a huge financial decision purchase that you want to make with confidence. One of…