Cedartown, GA Land Hard Money Loan

Log In

The subject property (Tract 5) is 73± acres of undeveloped land in Cedartown, GA. The borrower purchased the property in 2019 and is flipping it to a developer who has it under contract, along with tracts 1-4. The area is seeing major growth and national tenants surrounding the immediate area (including the Home Depot, Walmart, Tractor Supply, McDonald’s, Wendy’s, and a recently announced new Chick-fil-A).

Cedartown, GA Land Hard Money Loan Details

Structure

- Tax Document

- 1099-INT

- Offering Structure

-

BPDNx

SENIOR BPDN - PROMISSORY NOTE SECURED BY COLLATERAL SECURITY AGREEMENTTHIS PROMISSORY NOTE IS SECURED BY THE ISSUER'S PLEDGE OF THE RELEVANT UNDERLYING COLLATERAL LOAN (AS DEFINED BELOW) TO THE LENDER (AS DEFINED BELOW) UNDER THE COLLATERAL SECURITY AGREEMENT AND PROMISSORY NOTE. HOWEVER, EXCEPT TO THE LIMITED EXTENT PROVIDED IN THE PROMISSORY NOTE WITH RESPECT TO THE UNDERLYING COLLATERAL LOAN, THIS NOTE IS NON-RECOURSE TO THE ASSETS, FUNDS AND ACCOUNTS OF YIELDI, LLC (THE "BORROWER", "COMPANY" OR "ISSUER") OR ANY OF ITS AFFILIATES, EMPLOYEES, AGENTS, STOCKHOLDERS, PARENTS, OR SUBSIDIARIES EXCEPT TO THE EXTENT OF THE VALUE OF COLLATERAL LOAN NET PAYMENTS ACTUALLY RECEIVED IN RESPECT OF THE UNDERLYING BORROWER LOAN.

Example Return on Investment

-

Investment Amount:

-

Annual ROI:

-

$0

Why We Like This Opportunity

Cedartown, GA Land Hard Money Loan Highlights

The subject property (Tract 5) is 73± acres of undeveloped land in Cedartown, GA. The borrower purchased the property in 2019 and is flipping it to a developer who has it under contract, along with tracts 1-4. The area is seeing major growth and national tenants surrounding the immediate area (including the Home Depot, Walmart, Tractor Supply, McDonald’s, Wendy’s, and a recently announced new Chick-fil-A).

About the Neighborhood

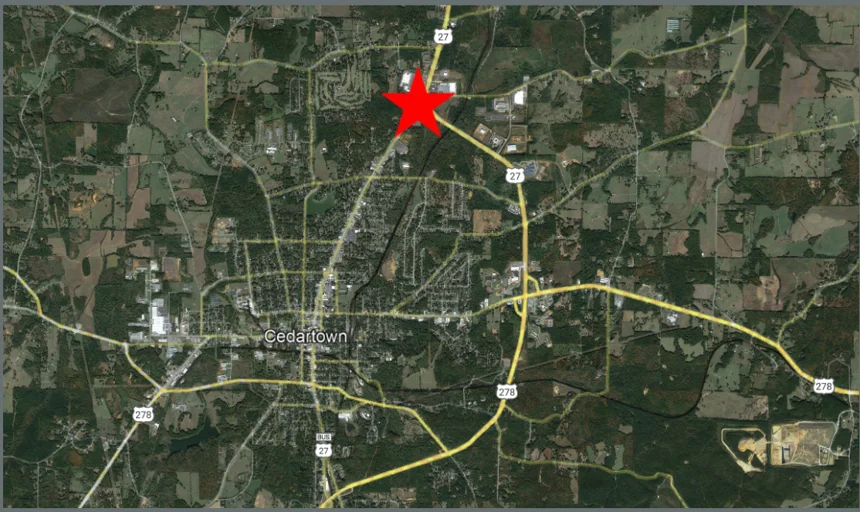

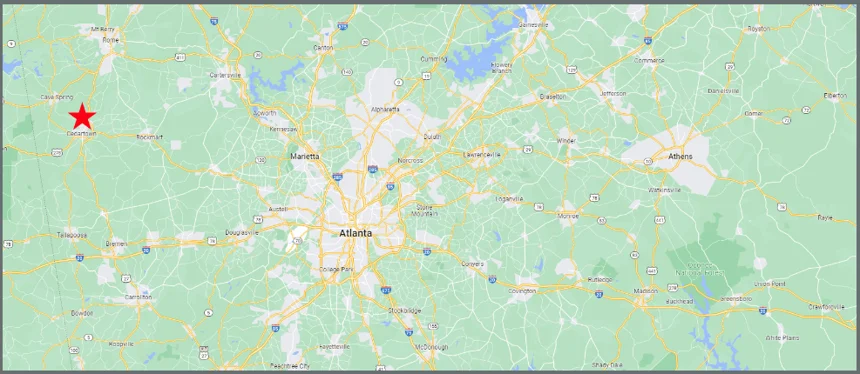

The Corners of Cedartown, is a 180± acre Mixed-Use Development Site, consisting of five separate parcels, all clustered around the intersection of North Main Street and Highway 27 in the City of Cedartown, Polk County Georgia. Polk County is located in the dynamic Northwest Georgia Corridor, 60 miles from Downtown Atlanta, 30 miles to Downtown Cartersville, and 19 miles to Downtown Rome.

Why We Like This Opportunity

This property is owned free and clear by the borrower and he has put himself in a great situation. The land is currently zoned C-2 commercial and the city manager, Ed Guzman, Polk County Dev Authority CEO, Chris White and Cedartown Development Director Oscar have all indicated they will provide all support to ensure the developers can build multi-family in the back and retail in the front of the lot. Regardless of the zoning, Yieldi is in a very strong position as it is highly sought after by multiple developers for commercial or residential.

Experienced Borrower

The borrower is a successful real estate investor in high-end real estate industry in Florida. He’s sold multiple Florida homes for over $2M+ and has a high net worth and strong liquidity.Seniority

The first-priority mortgage lien position is the most senior and highest priority within the capital structure. In the event that a borrower defaults, the lien priority determines the order in which lenders are repaid. Senior lenders are always repaid first. All subordinated positions, including the amount held by the Originator and its investor syndicate, act as a buffer in the event of a deterioration in the Properties’ value.Personal Guarantee

The Loans are personally guaranteed by the borrower, spouse, and all principals in the LLC. Additionally, the Sponsor and/or Guarantor are obligated to contribute monthly payments to maintain a tax and insurance reserve. Failure to adhere to reserve contribution requirements would lead to the triggering of a debt service and operating expense/shortfall guarantee.Investment Summary Of Cedartown, GA Land Hard Money Loan

Investors have an opportunity to invest in borrower payment dependent notes, the cash flow of which is dependent on the payment of interest and principal repayment on the Loans. Investors are scheduled to receive an annualized monthly interest payment of Login for details over the Loans' estimated remaining term of 12 Months. Principal is expected to be returned on or before maturity through a refinancing with a traditional bank loan. It is important to note that the Loans are eligible for prepayment, and principal may be repaid prior to the 12 Months estimated remaining term. If the Loans are paid off before maturity, investors are expected to receive at least three months of interest payments in addition to return of principal.

How Do I Get Paid?

This loan had an initial term of 12 Months with an option at Yieldi's discretion to extend. As of June 26, 2024 there are 12 Months remaining. Investors will immediately receive monthly interest payments at an annualized rate of Login for details on the principal balance over the life of the loan. If you invest in this loan in the middle of a month, you will receive a prorated interest payment for your investment for your first investment month and then full monthly payments thereafter. All payments are made automatically via ACH on the 1st of each month and investors all paid by the 10th of the month.

Additional Resources

How Long Does a Construction Project Take? A Guide for Real Estate Investors

When it comes to real estate investing, time isn’t just money — it’s everything. Knowing how long a construction project will take is essential for planning costs, securing financing, and projecting your returns. While every project is different, here’s a simple breakdown of what to expect. Typical Construction Timelines by Project Type Single-Family New Builds…

Are You an Experienced Builder in Atlanta? Don’t Miss This Bridge Lending Offer from Yieldi

For the first time ever, Yieldi is rolling out a targeted bridge lending offer—designed exclusively for seasoned homebuilders in key Southeastern cities. If you’ve been actively building and selling residential properties, this is your opportunity to access competitive funding with no cap on loan size. 🎯 Who Is This Offer For? This special bridge lending…

How Much Down Do Hard Money Lenders Need? (2025 Guide for Investors)

Hard money lending has emerged as a powerful financing tool for real estate investors. Whether you’re flipping houses, investing in short-term projects, or just getting started in the world of real estate, hard money loans offer speed and flexibility. But one key question lingers for both seasoned and first-time borrowers: How much down do hard…