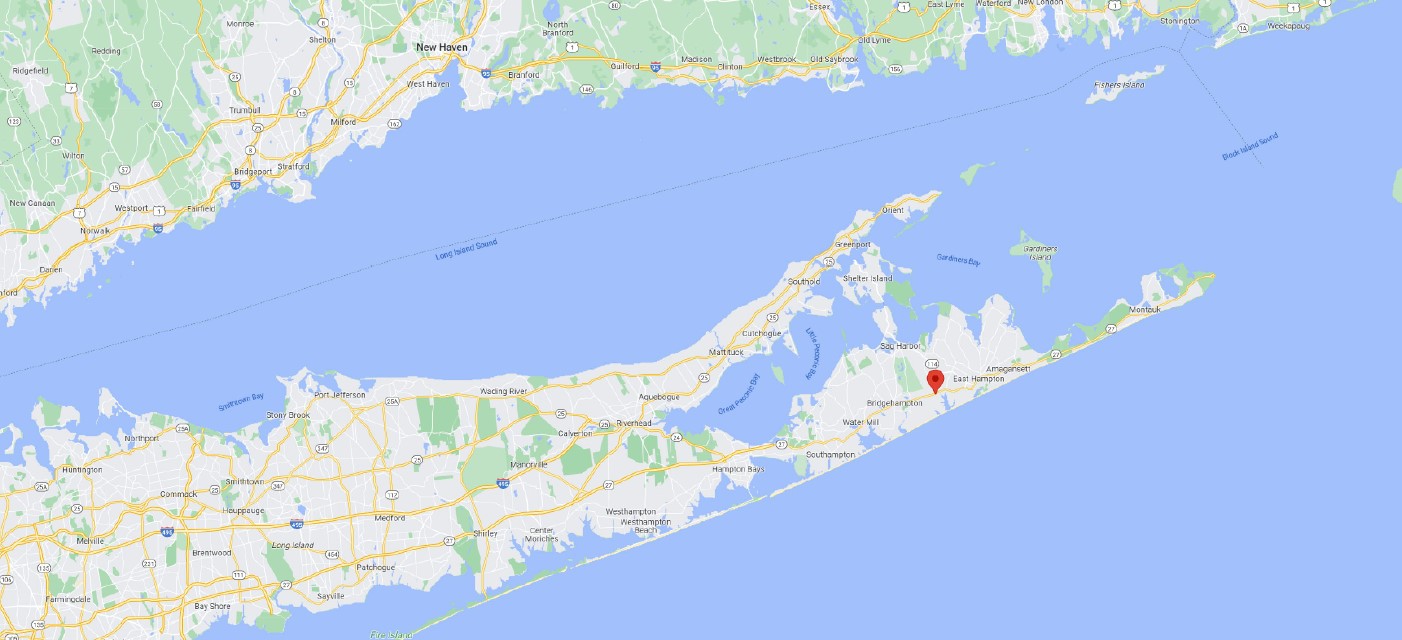

East Hampton, NY

Log In

A new opportunity in East Hampton, NY. This is one of the highest-income zip codes in the country. There is very little commercial/industrial zoning in East Hampton, so this kind of space is at a premium for local businesses, especially space with visibility on Montauk Highway – the busiest road and primary retail corridor. This can also be a retail/commercial use by-right. The existing building on the property is more than 30,000 sq ft and could be leased to a broad tenant base. The developers plan is to convert it into a heated and cooled storage facility.

East Hampton, NY Details

Structure

- Tax Document

- 1099-INT

- Offering Structure

-

BPDNx

SENIOR BPDN - PROMISSORY NOTE SECURED BY COLLATERAL SECURITY AGREEMENTTHIS PROMISSORY NOTE IS SECURED BY THE ISSUER'S PLEDGE OF THE RELEVANT UNDERLYING COLLATERAL LOAN (AS DEFINED BELOW) TO THE LENDER (AS DEFINED BELOW) UNDER THE COLLATERAL SECURITY AGREEMENT AND PROMISSORY NOTE. HOWEVER, EXCEPT TO THE LIMITED EXTENT PROVIDED IN THE PROMISSORY NOTE WITH RESPECT TO THE UNDERLYING COLLATERAL LOAN, THIS NOTE IS NON-RECOURSE TO THE ASSETS, FUNDS AND ACCOUNTS OF YIELDI, LLC (THE "BORROWER", "COMPANY" OR "ISSUER") OR ANY OF ITS AFFILIATES, EMPLOYEES, AGENTS, STOCKHOLDERS, PARENTS, OR SUBSIDIARIES EXCEPT TO THE EXTENT OF THE VALUE OF COLLATERAL LOAN NET PAYMENTS ACTUALLY RECEIVED IN RESPECT OF THE UNDERLYING BORROWER LOAN.

Example Return on Investment

-

Investment Amount:

-

Annual ROI:

-

$0

Why We Like This Opportunity

East Hampton, NY Highlights

This is one of the highest-income zip codes in the country. There is very little commercial/industrial zoning in East Hampton, so this kind of space is at a premium for local businesses, especially space with visibility on Montauk Highway – the busiest road and primary retail corridor. This can also be a retail/commercial use by-right. The existing building on the property is more than 30,000 sq ft and could be leased to a broad tenant base. The developers plan is to convert it into a heated and cooled storage facility.

About the Neighborhood

About the Developer

Mequity Companies (www.mequity.com) is a real estate group focused on the development, construction and operation of self storage facilities. Mequity’s primary target markets are the cities and surrounding metropolitan areas of New York City / Northern New Jersey; Boston; Philadelphia; Atlanta; and Miami / South Florida. The company’s principals, Bill Marsh and Robert Holly, are industry veterans, with deep connections in the self storage sector. Mequity has closed on over $310 million in self storage development projects composed of 1.6 million square feet of space since 2017. Mequity is also a repeat borrower for Yieldi and a well established operator.

Seniority

The first-priority mortgage lien position is the most senior and highest priority within the capital structure. In the event that a borrower defaults, the lien priority determines the order in which lenders are repaid. Senior lenders are always repaid first. All subordinated positions, including the amount held by the Originator and its investor syndicate, act as a buffer in the event of a deterioration in the Properties’ value.Personal Guarantee

The Loans are personally guaranteed by the borrower, spouse, and all principals in the LLC. Additionally, the Sponsor and/or Guarantor are obligated to contribute monthly payments to maintain a tax and insurance reserve. Failure to adhere to reserve contribution requirements would lead to the triggering of a debt service and operating expense/shortfall guarantee.What Should I Consider When Investing in East Hampton, NY?

Borrower Risk

The Borrower may not have represented itself accurately. Risk Mitigation- The Originator checks the Borrower's credit history via a third-party credit reporting company. The Borrower has a 700 credit score.

- The Originator considers the underlying asset to be the primary source of security.

- If the Loans are not fully repaid after the Lender has exhausted other sources of repayment, the Borrower has provided a personal guaranty to fulfill any deficiency.

Default Risk

The Borrower may default on his financial obligations. Risk Mitigation- If the Loans are not fully repaid after the Lender has exhausted other sources of repayment, the Sponsor has provided a personal guaranty to fulfill any deficiency.

- In the event of a default, a direction letter signed at closing by the Borrower will be sent redirecting the Tenant to make rent payments into an account controlled by the Originator.

Vacancy Risk

The Tenant may vacate the leased properties. Risk Mitigation- The Tenant is an investment grade rated company with sizable financial resources.

- Under the triple-net leases, the Tenant is under multi-year contract to pay rent with no option to terminate.

- If the Tenant decides not to renew any of the leases or to vacate the leased premises, the Borrower will pay for an appraisal of the property “as vacant” and the borrower will have to provide the additional cash collateral and/or pay down the loan (or any combination in between) within ten days of receipt of the appraisal in order to bring the property back to an LTV.

Investment Summary Of East Hampton, NY

Investors have an opportunity to invest in borrower payment dependent notes, the cash flow of which is dependent on the payment of interest and principal repayment on the Loans. Investors are scheduled to receive an annualized monthly interest payment of Login for details over the Loans' estimated remaining term of 12 Months. Principal is expected to be returned on or before maturity through a refinancing with a traditional bank loan. It is important to note that the Loans are eligible for prepayment, and principal may be repaid prior to the 12 Months estimated remaining term. If the Loans are paid off before maturity, investors are expected to receive at least three months of interest payments in addition to return of principal.

How Do I Get Paid?

This loan had an initial term of 12 Months with an option at Yieldi's discretion to extend. As of November 15, 2023 there are 12 Months remaining. Investors will immediately receive monthly interest payments at an annualized rate of Login for details on the principal balance over the life of the loan. If you invest in this loan in the middle of a month, you will receive a prorated interest payment for your investment for your first investment month and then full monthly payments thereafter. All payments are made automatically via ACH on the 1st of each month and investors all paid by the 10th of the month.

Additional Resources

Why Choose an Atlanta Hard Money Lender for Your Real Estate Investments?

Unlocking Opportunities: In the vibrant and competitive real estate markets of Metro Atlanta, traditional financing options often fail to meet the needs of investors looking for agility and flexibility. This is where hard money lenders step in, offering unique advantages that can make all the difference in seizing lucrative opportunities in areas like Alpharetta, Marietta,…

How Hard Money Loans can Expedite Commercial Real Estate Projects

Introduction In the dynamic world of commercial real estate, speed and efficiency are paramount. One financing option that can expedite these projects is hard money loans. Unlike traditional lending methods, hard money loans offer quick, flexible financing for real estate developers and investors. What are Hard Money Loans? Hard money loans are short-term loans secured…

What is an Accredited Investor?

What is an accredited investor and how are the rules and regulations evolving to allow more investment opportunities to a new category of investors.