New Orleans, Louisiana Hard Money Funded

Log In

Custom-designed, new construction home on approximately 5.9 acres in Claiborne Oaks, a boutique-style, gated community in Madisonville, Louisiana, boasting 5,300 square feet of living space. Near the beautiful city of New Orleans.

New Orleans, Louisiana Hard Money Funded Details

Structure

- Tax Document

- 1099-INT

- Offering Structure

-

BPDNx

SENIOR BPDN - PROMISSORY NOTE SECURED BY COLLATERAL SECURITY AGREEMENTTHIS PROMISSORY NOTE IS SECURED BY THE ISSUER'S PLEDGE OF THE RELEVANT UNDERLYING COLLATERAL LOAN (AS DEFINED BELOW) TO THE LENDER (AS DEFINED BELOW) UNDER THE COLLATERAL SECURITY AGREEMENT AND PROMISSORY NOTE. HOWEVER, EXCEPT TO THE LIMITED EXTENT PROVIDED IN THE PROMISSORY NOTE WITH RESPECT TO THE UNDERLYING COLLATERAL LOAN, THIS NOTE IS NON-RECOURSE TO THE ASSETS, FUNDS AND ACCOUNTS OF YIELDI, LLC (THE "BORROWER", "COMPANY" OR "ISSUER") OR ANY OF ITS AFFILIATES, EMPLOYEES, AGENTS, STOCKHOLDERS, PARENTS, OR SUBSIDIARIES EXCEPT TO THE EXTENT OF THE VALUE OF COLLATERAL LOAN NET PAYMENTS ACTUALLY RECEIVED IN RESPECT OF THE UNDERLYING BORROWER LOAN.

Example Return on Investment

-

Investment Amount:

-

Annual ROI:

-

$0

Why We Like This Opportunity

New Orleans, Louisiana Hard Money Funded Highlights

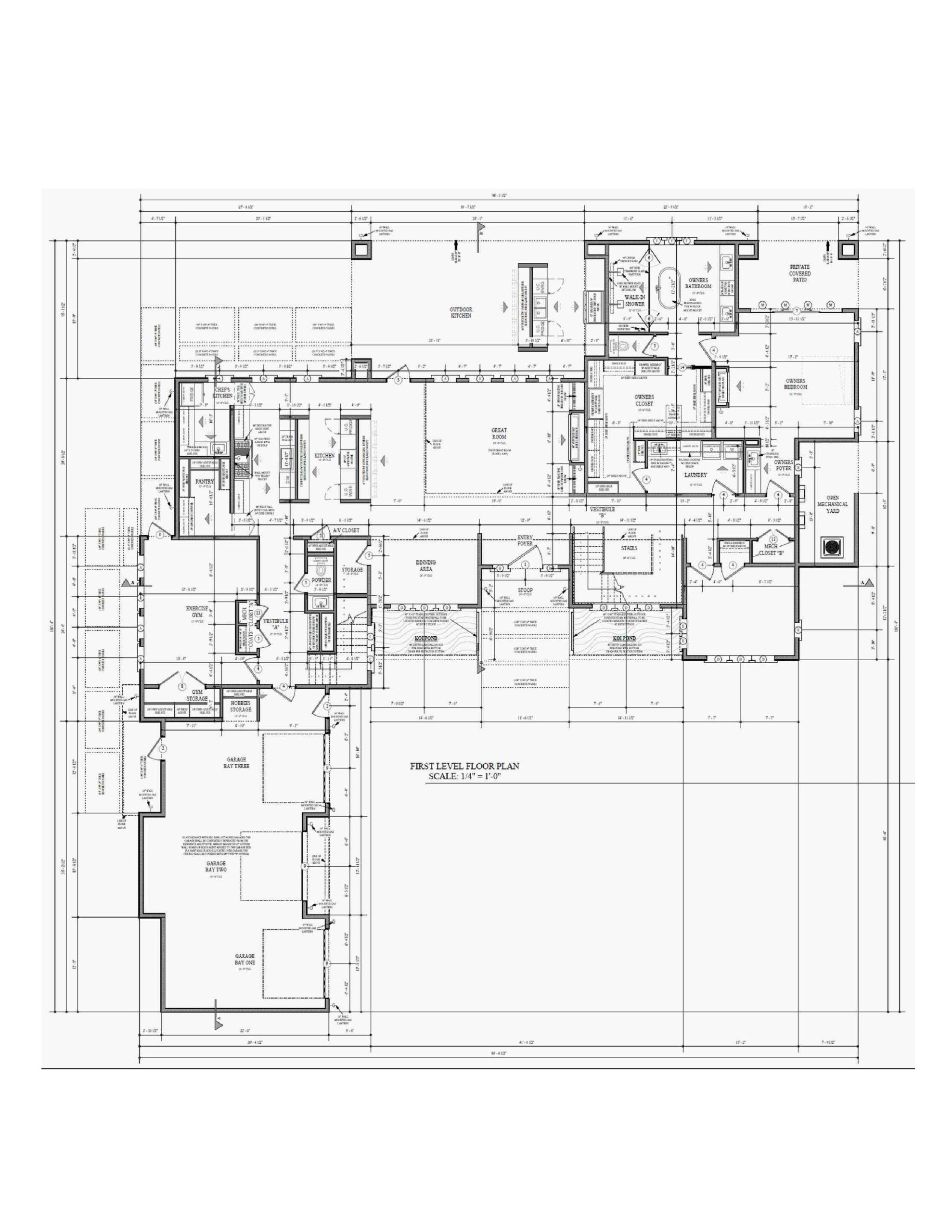

Custom-designed, new construction home on approximately 5.9 acres in Claiborne Oaks, a boutique-style, gated community in Madisonville, Louisiana. Custom build boasts 5,300 square feet of living space including 5 bedrooms, 4 bathrooms, and a main-level open floor plan expanding into an outdoor retreat area showcasing an outdoor kitchen, sundeck, in-ground gunite pool, and spa. Game Room and Theater Room can be found on the second floor along with an open sundeck on South and West of the home.

About the Neighborhood

Claiborne Oaks is a neighborhood of luxury homes located in Madisonville, Louisiana, a town in the Parish of St. Tammany, hugging the banks of the Tchefuncte River. Known for its annual world-renowned Wooden Boat Festival, you will also find waterfront restaurants and water activities within minutes of home. The city sits just south and southeast of the fast-growing cities of Covington and Mandeville and is close enough to the big-city wonders of New Orleans that residents can enjoy the complete cultural calendar there via a quick jog across the Lake Pontchartrain Causeway. Nearby swamps and lakes also make Madisonville a perfect spot for residents who want to enjoy the pleasures of Louisiana’s hunting, fishing, boating, hiking and camping meccas.

Exit Strategy

The property will be listed for sale at $1,500,000.00 putting our loan at less than 50% LTV. This is a seasoned developer with previous sales in the area.

Experienced Borrower

The borrower is a successful real estate investor in high-end real estate industry in Florida. He’s sold multiple Florida homes for over $2M+ and has a high net worth and strong liquidity.Seniority

The first-priority mortgage lien position is the most senior and highest priority within the capital structure. In the event that a borrower defaults, the lien priority determines the order in which lenders are repaid. Senior lenders are always repaid first. All subordinated positions, including the amount held by the Originator and its investor syndicate, act as a buffer in the event of a deterioration in the Properties’ value.Personal Guarantee

The Loans are personally guaranteed by the borrower, spouse, and all principals in the LLC. Additionally, the Sponsor and/or Guarantor are obligated to contribute monthly payments to maintain a tax and insurance reserve. Failure to adhere to reserve contribution requirements would lead to the triggering of a debt service and operating expense/shortfall guarantee.

Upfront Reserve

The Loan is structured with interest reserve for further protection. 12 months of debt service payments will be collected at closing.What Should I Consider When Investing in New Orleans, Louisiana Hard Money Funded?

Borrower Risk

The Borrower may not have represented itself accurately. Risk Mitigation- The Originator checks the Borrower's credit history via a third-party credit reporting company. The Borrower has a 700 credit score.

- The Originator considers the underlying asset to be the primary source of security.

- If the Loans are not fully repaid after the Lender has exhausted other sources of repayment, the Borrower has provided a personal guaranty to fulfill any deficiency.

Default Risk

The Borrower may default on his financial obligations. Risk Mitigation- If the Loans are not fully repaid after the Lender has exhausted other sources of repayment, the Sponsor has provided a personal guaranty to fulfill any deficiency.

- In the event of a default, a direction letter signed at closing by the Borrower will be sent redirecting the Tenant to make rent payments into an account controlled by the Originator.

Investment Summary Of New Orleans, Louisiana Hard Money Funded

Investors have an opportunity to invest in borrower payment dependent notes, the cash flow of which is dependent on the payment of interest and principal repayment on the Loans. Investors are scheduled to receive an annualized monthly interest payment of Login for details over the Loans' estimated remaining term of 12 Months. Principal is expected to be returned on or before maturity through a refinancing with a traditional bank loan. It is important to note that the Loans are eligible for prepayment, and principal may be repaid prior to the 12 Months estimated remaining term. If the Loans are paid off before maturity, investors are expected to receive at least three months of interest payments in addition to return of principal.

How Do I Get Paid?

This loan had an initial term of 12 Months with an option at Yieldi's discretion to extend. As of April 22, 2022 there are 12 Months remaining. Investors will immediately receive monthly interest payments at an annualized rate of Login for details on the principal balance over the life of the loan. If you invest in this loan in the middle of a month, you will receive a prorated interest payment for your investment for your first investment month and then full monthly payments thereafter. All payments are made automatically via ACH on the 1st of each month and investors all paid by the 10th of the month.

Additional Resources

Are You an Experienced Builder in Atlanta? Don’t Miss This Bridge Lending Offer from Yieldi

For the first time ever, Yieldi is rolling out a targeted bridge lending offer—designed exclusively for seasoned homebuilders in key Southeastern cities. If you’ve been actively building and selling residential properties, this is your opportunity to access competitive funding with no cap on loan size. 🎯 Who Is This Offer For? This special bridge lending…

How to Get a Hard Money Loan for Investment Properties

Investing in real estate often means moving quickly. At Yieldi, we specialize in hard money loans that give investors fast, flexible financing — without the red tape of traditional banks. Whether you’re buying a fix-and-flip, building new construction, or expanding your rental portfolio, here’s how to secure funding with Yieldi. What is a Hard Money…

Why Georgia is One of the Best States for Real Estate Investors in 2025

Looking to expand your real estate portfolio in 2025? Smart investors across the country have their eyes on Georgia — and for good reason. With strong population growth, booming economic hubs, and a housing market that still offers plenty of opportunity, Georgia is quickly becoming one of the best states to invest in real estate….