Nashville, TN

Log In

This home is nestled on one of the most coveted streets in Nashville. This early 20th-century federal-style gem stands as a testament to timeless elegance. With meticulous preservation of its original details combined with contemporary renovations, this home harmoniously blends the charm of yesteryears with the comforts of today.

Nashville, TN Details

Structure

- Tax Document

- 1099-INT

- Offering Structure

-

BPDNx

SENIOR BPDN - PROMISSORY NOTE SECURED BY COLLATERAL SECURITY AGREEMENTTHIS PROMISSORY NOTE IS SECURED BY THE ISSUER'S PLEDGE OF THE RELEVANT UNDERLYING COLLATERAL LOAN (AS DEFINED BELOW) TO THE LENDER (AS DEFINED BELOW) UNDER THE COLLATERAL SECURITY AGREEMENT AND PROMISSORY NOTE. HOWEVER, EXCEPT TO THE LIMITED EXTENT PROVIDED IN THE PROMISSORY NOTE WITH RESPECT TO THE UNDERLYING COLLATERAL LOAN, THIS NOTE IS NON-RECOURSE TO THE ASSETS, FUNDS AND ACCOUNTS OF YIELDI, LLC (THE "BORROWER", "COMPANY" OR "ISSUER") OR ANY OF ITS AFFILIATES, EMPLOYEES, AGENTS, STOCKHOLDERS, PARENTS, OR SUBSIDIARIES EXCEPT TO THE EXTENT OF THE VALUE OF COLLATERAL LOAN NET PAYMENTS ACTUALLY RECEIVED IN RESPECT OF THE UNDERLYING BORROWER LOAN.

Example Return on Investment

-

Investment Amount:

-

Annual ROI:

-

$0

Why We Like This Opportunity

Nashville, TN Highlights

This home is nestled on one of the most coveted streets in Nashville. This early 20th-century federal-style gem stands as a testament to timeless elegance. With meticulous preservation of its original details combined with contemporary renovations, this home harmoniously blends the charm of yesteryears with the comforts of today. This special property represents a rare slice of Belle Meade history, thoughtfully reimagined for modern living. An impressive 5,440 sq feet with 4 spacious bedrooms and 4.5 luxurious bathrooms, offering ample space for family living and entertaining. The primary bedroom suite on the main level ensures convenience and privacy.

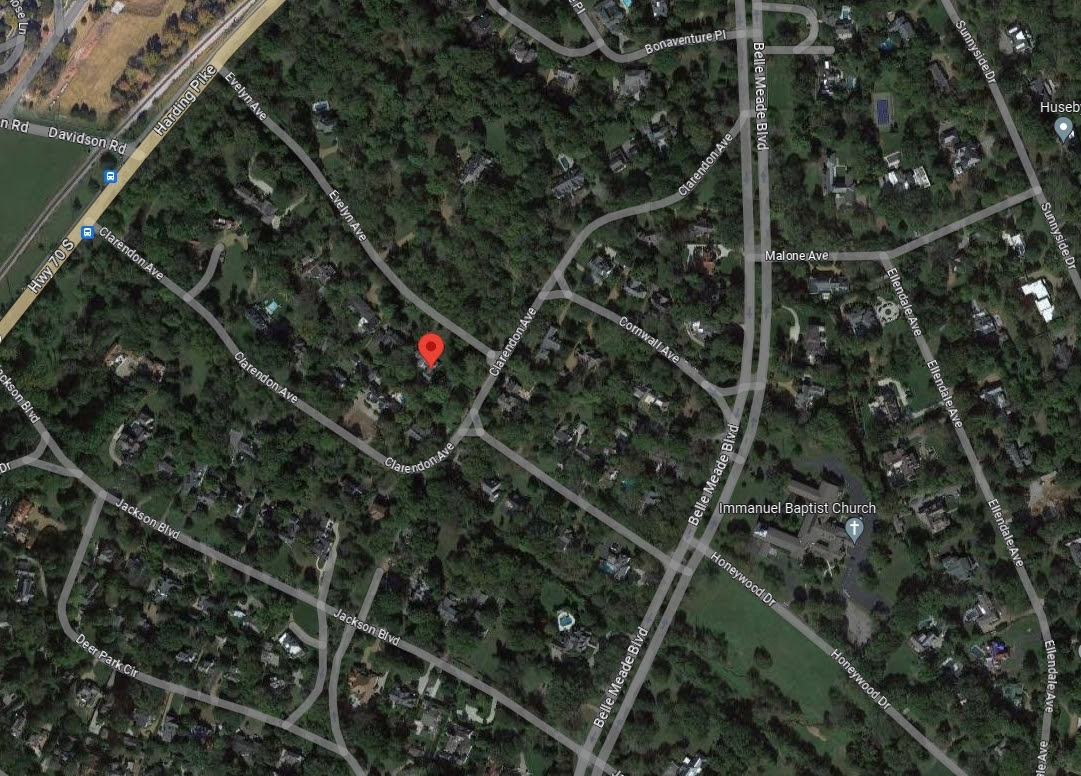

About the Neighborhood

Deerfield is a neighborhood of luxury homes in Nashville offering an assortment of beautiful styles, varying sizes and affordable prices to choose from. Deerfield single family homes range in square footage around 5,400 square feet and in price at approximately $3,645,000.

Why We Like This Opportunity

The borrower purchased this home in 2019 and has spent approximately $350,000 on remodeling. The sponsor has strong financials and a lot of equity in the property. The property is in a highly desirable neighborhood in a market that is outpacing the rest of the country in single family home appreciation. The borrower has the property currently listed for sale, which will be their eventual exit from the loan. This bridge loan is to free up some cash from their renovation.

Seniority

The first-priority mortgage lien position is the most senior and highest priority within the capital structure. In the event that a borrower defaults, the lien priority determines the order in which lenders are repaid. Senior lenders are always repaid first. All subordinated positions, including the amount held by the Originator and its investor syndicate, act as a buffer in the event of a deterioration in the Properties’ value.Personal Guarantee

The Loans are personally guaranteed by the borrower, spouse, and all principals in the LLC. Additionally, the Sponsor and/or Guarantor are obligated to contribute monthly payments to maintain a tax and insurance reserve. Failure to adhere to reserve contribution requirements would lead to the triggering of a debt service and operating expense/shortfall guarantee.

Upfront Reserve

The Loan is structured with interest reserve for further protection. 12 months of debt service payments will be collected at closing.What Should I Consider When Investing in Nashville, TN?

Borrower Risk

The Borrower may not have represented itself accurately. Risk Mitigation- The Originator checks the Borrower's credit history via a third-party credit reporting company. The Borrower has a 700 credit score.

- The Originator considers the underlying asset to be the primary source of security.

- If the Loans are not fully repaid after the Lender has exhausted other sources of repayment, the Borrower has provided a personal guaranty to fulfill any deficiency.

Default Risk

The Borrower may default on his financial obligations. Risk Mitigation- If the Loans are not fully repaid after the Lender has exhausted other sources of repayment, the Sponsor has provided a personal guaranty to fulfill any deficiency.

- In the event of a default, a direction letter signed at closing by the Borrower will be sent redirecting the Tenant to make rent payments into an account controlled by the Originator.

Investment Summary Of Nashville, TN

Investors have an opportunity to invest in borrower payment dependent notes, the cash flow of which is dependent on the payment of interest and principal repayment on the Loans. Investors are scheduled to receive an annualized monthly interest payment of Login for details over the Loans' estimated remaining term of 12 Months. Principal is expected to be returned on or before maturity through a refinancing with a traditional bank loan. It is important to note that the Loans are eligible for prepayment, and principal may be repaid prior to the 12 Months estimated remaining term. If the Loans are paid off before maturity, investors are expected to receive at least three months of interest payments in addition to return of principal.

How Do I Get Paid?

This loan had an initial term of 12 Months with an option at Yieldi's discretion to extend. As of September 20, 2023 there are 12 Months remaining. Investors will immediately receive monthly interest payments at an annualized rate of Login for details on the principal balance over the life of the loan. If you invest in this loan in the middle of a month, you will receive a prorated interest payment for your investment for your first investment month and then full monthly payments thereafter. All payments are made automatically via ACH on the 1st of each month and investors all paid by the 10th of the month.

Additional Resources

Are You an Experienced Builder in Atlanta? Don’t Miss This Bridge Lending Offer from Yieldi

For the first time ever, Yieldi is rolling out a targeted bridge lending offer—designed exclusively for seasoned homebuilders in key Southeastern cities. If you’ve been actively building and selling residential properties, this is your opportunity to access competitive funding with no cap on loan size. 🎯 Who Is This Offer For? This special bridge lending…

How to Raise Private Money for Your Real Estate Investment

Raising private money for your real estate projects isn’t as elusive as it might seem. Whether you’re diving into a promising fix-and-flip or looking to secure a multi-unit rental property, you need the necessary funds on hand to seize the moment. However, traditional banks and lenders operate too slowly—and that’s where private money lending comes…

What is an Accredited Investor?

What is an accredited investor and how are the rules and regulations evolving to allow more investment opportunities to a new category of investors.